You’re probably wondering why a successful and talented financial advisor would need to think about marketing their business. After all, isn’t it enough to get some clients and be good at what you do? Not exactly. In today’s market, anyone can call themselves a financial “advisor” or money coach (okay…compliance and laws say otherwise but you get where we’re going). But not everyone is in the same league when it comes to skills and expertise. In order to stand out from the crowd and attract new clients that are perfect fits for your financial advisor firm—as well as keep existing ones happy—you need an effective marketing plan.

It’s time to rethink traditional financial advisor marketing

If you haven’t done it already, it’s time to rethink traditional financial advisor marketing.

Advertising on TV, in print or even on social media is not going to get you the results you need. Most of these channels are expensive and ineffective at attracting new clients. Not to mention – they’re INCREDIBLY HARD TO TRACK. We want the data, and we want to make marketing investment decisions based on results, right? Mmm hmm. Even having just a website isn’t cutting it anymore. Many financial advisors have outdated sites, poorly written website copy that doesn’t answer important questions, and no visibility on Google search results for keywords that would lead prospects straight to them!

The internet is the best way to reach your target audience and find new clients, but if you don’t have an effective strategy in place with execution tactics in mind then all your efforts will be wasted. Here’s a few of our favorite, and proven, tactics that our financial advisor clients have seen over 850% growth with across the board.

Refresh your branding so your company has a personality.

Branding is more than just a logo, it’s your first impression and data shows you get less than 5 seconds to make a positive one.

Branding is about how your clients and prospects perceive you, feel about you and think of you. Your website needs to be approachable and make people want to be friends with your brand (or fall in love so hard they believe your company would be their perfect marriage for their needs- love at first sight!).The first thing people see when they land on your website is the homepage. The goal of this page is to make visitors want to stay and then convert! It should tell them what you do, why it’s important and how you can help them. It should also be visually appealing so that people are excited about what they’re seeing and reading.

Refresh your website and optimize it for search.

Refresh your website and optimize it for search. You’re not going to get very far without a well-designed site that people can find easily. The best way to do this is by using a professional web designer who knows how to modernize your site and nail down your UX (user experience) for the best possible conversion rate optimization (CRO). SEO is critical to attracting new clients this day and age. The top financial advisors are using this to their advantage. This means you need to make sure you include a blog on your site (you’ll be writing a lot of content here!). You’ll also need to make sure each page has full titles/meta tags optimized for low hanging fruit keywords and create pages that provide helpful in-depth content that is visually appealing. Your website should also have videos, easily accessible navigation to other helpful content such as resources, and the pages you want them to view.

- TIP: Make sure you add your Google Analytics tag. With the Google Analytics tag added to your site there will be no more guessing about where conversions came from in your marketing efforts—you’ll have objective data telling you what works!

Get client testimonials that speak to what new clients can expect working with you.

Client testimonials are a great way to promote your business.

Place your testimonials throughout your website, but particularly important to have them on your home page for brand credibility purposes for that first impression. You want people who visit the site or pop into a meeting with you to know that other people like them have worked with you and were happy with it. It’s critical that new clients understand what they can expect when working with a financial advisor like you from their very first interaction. Bonus points if you’re able to get testimonials that highlight what makes you unique.

Not to mention, did you know that having really solid client testimonials can more than 3x your website conversion rates?! If you typically convert 3 out of every 100 people into leads who visit your home page, you can imagine how this quickly begins to become a game changer. If you get 1000 to your site in a month, now you’re talking 90 leads that month! Plus, this is a super easy conversion rate optimization tip to implement this month.

Create a content strategy that attracts your target audience

Start by taking a look at some of the financial advisors websites that you admire most. What type of content are they creating on their site? And how frequently?

Use tools like Ahrefs, SEMrush or Moz to conduct keyword research and perform an SEO content gap analysis to plan out which topics to write about. These tools provide invaluable data and insights into your competitors top performing web content, how much organic traffic they get each month, and what search queries have high search volumes and low keyword difficulties.

It’s also important to identify if any specific keywords are missing from your website or need more attention than others based on their user intent (i.e. long-tail keywords) in order to rank higher in Google SERPs over time–this will help attract new visitors who may be looking for information related specifically on those topics and topics only found within this space as well!

Create free content, like ebooks, guides, and industry reports as lead magnets to drive qualified leads.

People love data and trends when thinking about their financial wellbeing. Create a survey and then create a downloadable industry report. We’ve seen these bring in tons of qualified traffic, and they tend to get a ton of backlinks from other websites which is really helpful for SEO..

Use content as a lead magnet to get people interested in your services and sign up for your newsletter. Once you have their contact information you’ll be able to nurture them through your emails or even retarget them through other advertising channels if they download other helpful resources that you might have or schedule consultations with them.

We’ve seen these types of content help clients grow their lead lists by more than 10x. It’s really powerful and it just flat-out works!

Create an engaging, informative blog with plenty of helpful articles.

In the world of finance, blogs are an excellent way to create content that attracts attention because people are turning to search engines and social media to get their information. If a blog’s author is established as an authority on the subject, readers will be more likely to trust their advice. That authority should be you!! Plus, if you’re worried about getting started or don’t want to worry about writing your own content all the time, there are plenty of freelance writers who can help you out (and they may even charge less than what it would cost you in overhead). Make sure you properly vet your freelancers for the technicalities that come with financial services.

If you get stuck, reach out to us. We can point you in the right direction for how to find them. If you prefer that our team of financial industry marketing experts at Axle Eight can help you instead, we can talk that over too!

The best thing about blogs? They’re quick and easy to set up! That’s right—you don’t need any special equipment or software to start one up and get it running. All you need is an idea and some passion for sharing your expertise with others…pluuuus some data and research to support your topics and content strategy so you can optimize all of your posts for SEO and get more qualified traffic to your site, of course.

Update your website regularly to reflect new insights, strategies and trends that may affect your clients.

Keeping your website current is an important part of maintaining a strong online presence. Additionally, it sends search engine algorithms positive signals that increase your SEO.

Make sure that you’re consistent in the way you brand yourself online. Choose a style and stick with it across all of your social media channels, blog posts and your website. This will help build trust with your audience and give them an idea of what to expect from your content.

When you’re writing blog posts, think about how they can be used to drive traffic. Make sure that your blog has a consistent theme and focus on topics that are relevant to your business. If you’re not sure what kind of content your audience wants, try surveying them or running an online poll.

Use video marketing to demonstrate your expertise.

Videos are a great way to demonstrate your expertise as a financial advisor. You can further explain concepts such as the basics of investing, financial planning, portfolio diversification, term life insurance, dollar cost averaging, 529 plans, 1031 exchanges and so many other financial concepts in an easy-to-understand way, making it simple for clients who want to learn more about their finances but don’t want to read through pages of text and prefer video format.

Videos also show off your personality, which helps build trust with potential clients and makes them feel like they’re getting one-on-one attention from you.

When using video marketing in your business, there are three main things you should do:

- Talk about all the issues that affect people’s lives;

- Help them understand why their situation is different from everyone else’s and there is not a cookie cutter set and forget it approach that’s sustainable;

- Give specific advice on what needs changing and how they can achieve those changes (if appropriate).

Create an automated nurture email series to keep in touch with prospects.

Let’s say you’re already using something like Mailchimp or Infusionsoft (or whatever your favorite email platform is) to send out helpful content via email. You want to continue doing this, but also want to create some nurturing programs that will help keep prospects engaged and ready for sales conversations when they come along.

The best way to do this is through a series of automated emails that go out over the course of several weeks or even months after someone signs up for your newsletter. The key here is creating an engaging series that educates while also giving prospects just enough information so they know how best to move forward in their journey towards financial freedom with you as their financial advisor.

Some ideas include:

- Tips on building wealth (e.g. investing)

- Advice about what financial products might be best suited for them (e.g., life insurance vs term insurance vs long-term care insurance)

- Information about upcoming events and webinars related specifically toward helping people reach their goals (e.g., “5 Tips To Retire Early With Pension Income”). This way, it isn’t just all about the product; it’s also about helping people understand what might work best for them personally!

Send a newsletter that includes relevant news and advice, along with tips and tricks to build wealth.

Don’t underestimate the value of newsletters. They’re a great way to stay in touch with prospects that have gone dormant, and they can help you continue to be a thought leader for your existing clients. Newsletters are also an ideal way to highlight new services or products you offer, or other value added things like ebooks or guides, new blogs on topics relevant to your business, webinars, consultations and testimonials from happy clients. You can even use newsletters as an opportunity to highlight original video content you’ve created!

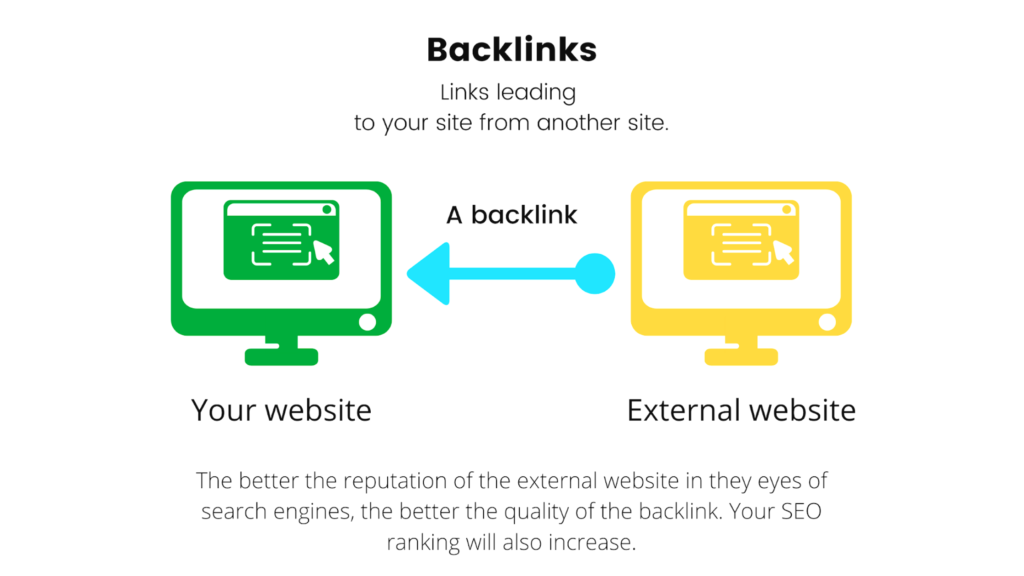

Get traffic from other websites through backlink building

Backlinks are important for SEO and help bring you additional web traffic. Get yourself listed online with all the major directories that clients look up when they’re shopping for advisors (S&P, Morningstar, third party websites and blogs, etc). These will not only get you new website traffic but will also get you that SEO bump by providing a backlink.

There are also several ways to creatively get backlinks. Reach out to bloggers who talk about finance and personal finance, ask them if they’d be willing to write a piece on your company or service – either pay them for it or trade some value (like promoting their blog post on social media). If a blogger writes something about your company/service then make sure there is a link back to your website (Ideally a do follow link) so that you can get additional SEO value and more traffic to your website! Pay attention though because not every site is created equal! Also think about what industry keywords might be valuable to your SEO strategy and see about getting those in anchors for your backlinks on these bloggers sites.

Use paid media to increase leads and grow your social following

Paid advertising is a great way to increase your leads and your social following. You can target your audience on numerous platforms like through Google search queries on Google Ads Manager or by certain job titles or industries on LinkedIn. We’ve seen financial advisors get great traction with high quality leads when doing targeted ads on LinkedIn and Facebook with solid content and lead magnet campaigns.

Run ads on social channels like LinkedIn, Facebook, and Instagram that get your target audience to take a simple action that provides them value, such as download a free industry report on a topic they care about, or some other guide, checklist or template to help them on their financial journey.

You can track your results with the direct advertising platforms like Google Ads, Facebook Ads Manager and LinkedIn Ads Manager so you know which campaigns are giving you the best ROI over time so you can replicate those successes with other campaigns later down the line.

Google analytics and UTMs will also allow you to be able to see which advertising channel was responsible for each conversion from these campaigns so if one lead comes through because someone clicked through from an ad but another two were from SEO efforts or email efforts, you’ll be able to tell!

Don’t be afraid to make the leap! Acquiring more clients for your financial advising business doesn’t have to be a chore.

Don’t be afraid to make the leap! Acquiring more clients for your financial advising business doesn’t have to be a chore. You can do it! And if you’re wondering why I’m sounding like a motivational speaker, it’s because this is an important part of your success.

When we get into fear mode, we stop ourselves from moving forward with our goals and ambitions. We become paralyzed by the anxiety and doubt that comes with taking risks on our own behalf or on behalf of others who need us in order to succeed at their own goals and ambitions. And when we allow ourselves to get stuck in this negative mindset, we end up losing out on opportunities that would otherwise help us grow our businesses (and lives) exponentially—if only we had stepped out of our comfort zone long enough to pursue them!

So don’t let fear keep you from growing your business; instead, use these tips as guidelines for overcoming any hesitation or apprehension about making new marketing plans work for your financial advising practice!

You can do this, but if you need help, Axle Eight is your financial advisor marketing expert team.

If you’re ready to take your financial advising business to the next level, it’s time to get creative. There are plenty of ways that you can use these marketing strategies and tactics as a financial advisor to attract more clients and grow your practice. Don’t be afraid! Take a step back from your day-to-day activities and think about how you can expand on what works and improve on what doesn’t. If you just don’t have the time or the team to fulfill this, Axle Eight is here to help. We’ve worked with countless financial services businesses and we know how to catapult yours into marketing marvel 😉 Reach out here and we’ll chat.